Many volunteers express frustration about understanding their council’s finances. They don’t know where to turn or how to translate what they’re being told and given at annual meetings and what these numbers represent. They also might wonder where the money is going. How do you find these things out? There are a couple of ways, but you should know going into it that you might have to educate yourself on accounting basics and do a little bit of research in order to gain an understanding of what information you’ll receive from financial reports.

Many volunteers express frustration about understanding their council’s finances. They don’t know where to turn or how to translate what they’re being told and given at annual meetings and what these numbers represent. They also might wonder where the money is going. How do you find these things out? There are a couple of ways, but you should know going into it that you might have to educate yourself on accounting basics and do a little bit of research in order to gain an understanding of what information you’ll receive from financial reports.

What’s a Fiscal Year?

Before beginning, it’s important to know what a fiscal year is. It’s a twelve month period in which a council budgets and tracks its finances. GSUSA’s fiscal year runs from October 1st to September 30th. Many councils also use this same time period. So if your council refers to FY2019, then it’s referencing the time period of 10/1/2018 through 9/30/2019. Other councils use the calendar year as their fiscal year; in that case, FY2019 would refer to 1/1/2019 through 12/31/2019.

Financial Reports and How to Use Them

Where can you find financial reports? Depending on the council, they could be posted on a council’s website, given to delegates, or provided in the annual report, which is usually given out at a council’s annual meeting. Sometimes reports can be referred to as “balance sheets” which is just a generic term for financial reports. But here’s where it might get confusing! The terminology can vary, and it’s also possible that the reports you receive from your council might not look like what’s described in this article. They might even be in summary form – and depending on what you’re looking for, they might not tell you much! But here’s what you can typically expect from a nonprofit organization’s financial documents.

When referring to financial reports, there are typically two different documents: a balance sheet and an income statement.

A balance sheet (also called the statement of financial position), basically displays a snapshot of where a nonprofit stands financially at the end of the fiscal year and how well it could deal with its obligations at that point in time. Two of the things you should make note of are the council’s assets and liabilities. This brief summary from Investopedia explains the basic types of assets and liabilities, defines equity, and also walks you through what’s in a balance sheet.

If you have questions about specifics such as how much was spent on occupancy & rent, you can see those items broken out in the income statement (also known as a statement of activities). Revenue and expenses are highlighted in the income statement and can give you an idea of what is earned and spent on the operational side of the council. When you hear about a council “running in the red or the black,” the income statement is where you can see these figures. Keep in mind nonprofits are different from for-profit businesses, so councils don’t earn profits. They run either a surplus, where more revenue is coming in than expenses, or a deficit, which is the opposite. A council being “in the red” for one year is not a cause for panic – but if you see it year after year, then that’s not sustainable, and questions should be raised as to why this is happening. You can find out more about income statements at this website from Accounting Tools.

If you have a basic knowledge of accounting, then you’re ahead of the game. If not, and if you really want to know what is going on with your council’s finances in detail, then it’s going to take some dedication, research, and self education. This guide on accounting basics is a good place to start. Here’s another one that’s specific to nonprofits. There’s probably an Accounting for Dummies guide out there that will be helpful too. It’s not necessary go into extreme detail, but you should have at the very least an understanding about the basics like the differences between assets & liabilities and revenue & expenses. It’s very easy to misunderstand what your council is reporting if you don’t understand these concepts. Be sure to visit the links about accounting as this article’s purpose is just to cover the highlights of what you as a volunteer would want to educate yourself on when it comes to your council’s finances. Then it’s up to you to take it further if there’s something that catches your attention.

So where can you get these documents? Some councils post them directly on their websites. At the very least, they should be distributed at annual meetings to delegates and readily available upon request for non-delegates. Transparency is key when it comes to nonprofits, because without it, your organization risks losing its membership’s and financial supporters’ trust – plus, there could be possible legal ramifications. The National Council of Nonprofits suggests ten ways that nonprofits can demonstrate financial transparency. If your council still won’t give you financial reports or gives you grief about it, then you should question its transparency.

Yearly audits are another way financial data can be presented. They are put together by a third party auditor and are more in-depth than financial reports – and like the other financial documents, they provide a snapshot on the last day of the fiscal year. Some councils post audits on their website while others make them available upon request.

As mentioned previously, audits and council-provided financial reports provide a static picture of the council’s financial status at the end of that fiscal year. But while useful, sometimes these single snapshots can misrepresent a council’s true financial picture. It’s subject to a lot of change – and sometimes rapid change, especially if a council has reserves invested in the market (which of course it should) or if there’s something unusual that happens within a fiscal year, such as a large bequest. So studying trends over time is also very important and one of the things a council’s finance committee should be doing. This is something you can do as well, but it will involve an investment of your time.

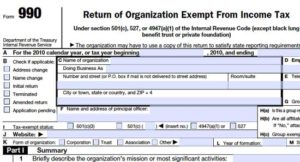

Councils are required to supply GSUSA with a copy of a financial audit, the management letter (a letter from the auditor to the board of directors), and its IRS Form 990. The 990 is yet another source to see a council’s financials.

Council 990s

501(c)(3)s, also known as nonprofit corporations, are required to file a 990 form with the IRS (with some exceptions). It’s a very lengthy tax form that breaks out a nonprofit’s finances much like the reports described earlier in this article.

501(c)(3)s, also known as nonprofit corporations, are required to file a 990 form with the IRS (with some exceptions). It’s a very lengthy tax form that breaks out a nonprofit’s finances much like the reports described earlier in this article.

How do you find your council’s 990s? Your council might have them available for download on its website or will send one to you upon request. GuideStar.org will have the past four years on file. You can create a free account, and once you’re logged in, basic information (such as 990s) are free. Subscriptions are offered, but for what you need, it’s not necessary. CharityNavigator.org (also a free account) might have a few more on record, and it might be possible via Google searches to find previous fiscal years even further back than what’s available from those two websites. The best source is ProPublica which in many cases has 990s all the back to 2001.

There is a downside to using 990s versus council-provided financial reports. They usually aren’t released until almost a year after the financial year ends, so you’re going to be looking at old data. But, they are helpful if you’re tracking numbers through the years or looking for trends.

Here are some helpful links about 990s:

- Highlights of IRS Form 990 – a quick guide from GuideStar that’s a helpful resource

- How to Assess Nonprofit Financial Performance – this paper is from 2001, so it’s a little dated, but it still does a good job walking through a 990 form and how nonprofits’ financials differ from for-profit companies

- How to Read the IRS Form 990 – a little dated because the original website this was pulled from now charges for the information

- The IRS’s 990 Guide – if you’re brave enough (cause it’s a long one!), bookmark this site because it’s THE source for what each line on the 990s specifically refers to

One thing that’s broken out in 990s that’s not necessarily found in council-provided reports is fundraising expenses. This is a very important factor to find how efficient a nonprofit is when it comes to raising money. While fundraising expenses in and of itself are not bad, if there’s an excessive amount, then that could be a red flag – but not necessarily.

What do I do with this information when I get it?

There are differing opinions when it comes to evaluating nonprofits, but according to Charity Navigator, three things should be studied:

- the financial health of the organization (which you can find via financial reports and 990s),

- accountability and transparency (how easily you can get this information), and

- the results (which you can judge for yourself).

For specifics about these three topics, definitely read through Charity Navigator’s above explanation. If you like to crunch numbers, then Charity Navigator also provides some formulas to determine financial efficiency. The great thing about Charity Navigator’s article is that it tells you where you can find the amounts in the 990 and even the specific line on the form.

What about budgets?

Budgets are an essential and critical part of a nonprofit. They are plans of expected revenues and expenses for a fiscal year and should reflect a council’s strategic priorities. They’re usually created by a board of director’s finance committee and the council’s financial staff, reviewed by the entire board, and then finally approved by the board. Budgets are usually reviewed every month by the finance committee and compared to what’s actually coming in for revenues and expenses in order to know where the council stands as the year progresses. Can you get a copy? Many councils and organizations in general consider the budget to be a confidential document because considerable sensitive information is contained in it, so don’t be surprised if your request is denied.

Budgets are an essential and critical part of a nonprofit. They are plans of expected revenues and expenses for a fiscal year and should reflect a council’s strategic priorities. They’re usually created by a board of director’s finance committee and the council’s financial staff, reviewed by the entire board, and then finally approved by the board. Budgets are usually reviewed every month by the finance committee and compared to what’s actually coming in for revenues and expenses in order to know where the council stands as the year progresses. Can you get a copy? Many councils and organizations in general consider the budget to be a confidential document because considerable sensitive information is contained in it, so don’t be surprised if your request is denied.

That said, even if you do not get a copy of the actual budget, it IS a valid question to ask if the council stays within its budget for a year. In other words, does it spend what is predicted, and if not, what’s the explanation for large variances? It’s also legitimate to ask whether the council budget is a deficit budget (spending more than the expected revenue in a given year), a “break-even” budget (where revenues equal expenses), or a surplus budget (spending less than the expected revenue in a year). There are reasons to justify each of these types of decisions in budgets, but if a council’s financial plan is for a deficit budget year after year, that’s not sustainable. Surplus budgets year after year are acceptable if the council is deliberately saving for a known purpose such as building up its reserves after some years of deficit budgets or there are plans to develop properties. If a council is running on an even financial keel (meaning no deficits) and doesn’t have a specific purpose to save money, a “break-even” budget is what is fairest in Girl Scouting. And that’s because such a substantial percentage of a council’s annual budget comes directly from girls in the form of product sales, program fees, and (for those councils who have them) service fees.

Summary

There are no hard-and-fast rules when it comes to nonprofit finances. Some feel it’s more important to see the whole picture over a few years to spot any concerning trends rather than looking at a snapshot picture from a single fiscal year. When you ask questions of your council’s leadership, ask from the point of view of a stakeholder who is interested in coming to a better understanding of the council’s financial picture. A council’s board of directors and leadership should openly explain what’s going on. Asking how the finances are related to the council’s strategic priorities is a legitimate question.

If your council balks at releasing its financial documents, then your state’s nonprofit act might give you some guidance about what a nonprofit is required to release to the organization’s members or the public.